tax refund reddit 2021 canada

The day after you overpaid your taxes. Residents of Massachusetts and Maine have until April 19 2022.

My refund arrived yesterday to the tune of 737755.

. This is the main menu page for the T1 General income tax and benefit package for 2021. Use our simple 2021 income tax calculator for an idea of what your return will look like this year. Canadas Top Growing Companies ranks Canadian companies on three-year revenue growth.

Alberta tax calculator British Columbia tax calculator Manitoba tax calculator New Brunswick tax calculator Newfoundland and Labrador tax calculator Nova Scotia tax calculator Northwest Territories tax calculator Nunavut tax calculator Ontario tax calculator Prince Edward Island tax calculator. I also havent filed my taxes yet. Have a refund of 2 or less.

Interest on your refund. However taxes for 2021 must be filed by April 18 2022 due to a legal holiday in Washington DC. Province Select Province Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward.

Change address in 2021 tax return or 2022. Finally earnings above 220000 will be taxed at a rate of 1316. While travelling be sure to keep all eligible receipts and upon your return home send in your receipts and completed application signed and dated.

The CRA will pay you compound daily interest on your tax refund for 2021. If you reside in Canada wait 8 weeks before contacting the Canada Revenue Agency for an update on your tax return and refund status. Help Reddit coins Reddit premium.

Throughout the year make sure you keep all relevant receipts bank records and any other supporting documents as proof of your expenses. I dont get the keys til Saturday. TurboTax is not ready to process Tax Year 2021 for the return.

Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. I initially tried to transmit the Federal MA and RI tax returns together and received this message. Wait until April 30th and pay off my wifes balance owed to CRA 803525.

I have US sourced income reported on a W2 after I became a canadian resident. The tax rates for Ontario in 2021 are as follows. Single adult or first adult in a couple 1.

The CRA offers a variety of credits and deductions to those eligible which help you reduce your tax owed. Climate Action Incentive Payment Amounts as Specified by the Minister of Finance for 2021 Delivered Through 2020 Personal Income Tax Returns Amount Ontario Manitoba Saskatchewan Alberta. Nevertheless given the low cost and all of the fantastic features available UFile is one of the best tax filing software programs in Canada for 2021 and beyond.

Certified and approved by the CRA and Revenu Quebec. The 31st day after you file your return. I just purchased my first condo but I havent moved in yet.

If you reside outside of Canada wait 16 weeks. When Are Taxes Due. For most years the deadline to submit your tax return and pay your tax bill is April 15.

Check out our list of tips and tricks to see how you can use tax credits and tax deductions to get more money back this tax season. Any repayments made in 2021 will be recognized on a T4A slip for 2021 which will allow the individual to claim a deduction on the. Prince Edward Island Tax Centre 275 Pope Road Summerside PE C1N 6A2 CANADA.

Call 1-800-959-5525 from within Canada or from the. Amounts 90287 up to 150000 the rate is 1116. For more information see Prescribed interest rates.

2021 income tax calculators based on provinces. Earnings 150000 up to 220000 the rates are 1216. What am I going to do with it.

I am a US Green card holder and a Canadian citizen who moved back to Canada during the 2021 year. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Here are some of the common receipts you should have handy when you start filing your 2021 tax return.

Find out your federal taxes provincial taxes and your 2021 income tax refund. Canada income tax calculator. Amounts above 45142 up to 90287 are taxed at 915.

Help Reddit coins Reddit premium. To provide immediate support for families with young children the Government proposes to provide in 2021 four tax-free payments of 300 per child under the age of six to families entitled to the Canada child benefit CCB with family net income equal to or less than 120000 and 150 per child under the age of six to families entitled to the CCB with family net. I was able to transmit the Federal and MA tax returns individually.

Should I declare the change of address on this years tax return or next years. The calculation will start on the latest of the following three dates. Enjoy the maximum refund plus a 100 accuracy guarantee.

Posted by 21 days ago. Has been featured on the 2021 Report on Business ranking of Canadas Top Growing Companies by The Globe and Mail. Individuals can select the link for their place of residence as of December 31 2021 to get the forms and information needed to file a General income tax and benefit return for 2021.

2021 Tax Return - Put option sold in 2021 with expiration in 2022. Amounts earned up to 45142 are taxed at 505. File your 2021 tax return for free online 15 cash bonus Use Canadas best free tax software and get a 15 bonus.

Tax Software Buying Guide If youre still struggling to find the right tax return software and you dont know what to look out for were here to help. Each package includes the guide the return and related schedules and the provincial information. Youll get a rough estimate of how much youll get back or what youll owe.

Are there any advantages or disadvantages either way. Start your 2021 tax for free. Top 20 Ways to Maximize Your Tax Return in 2022 Are you ready to maximize your tax return in 2022.

490 Second adult in a couple or first child of a single parent 2. Get a free entry into a. To check on the status of your FCTIP rebate.

My Account gives you secure online access to your tax return information. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or the.

Where Are Americans The Happiest Vivid Maps American History Timeline Map America Map

براءة إختاع جديدة من Dell قد تعني تطوير لاب توب بشاشة قابلة للطي Corporate Strategy Best Android Phone Computer Technology

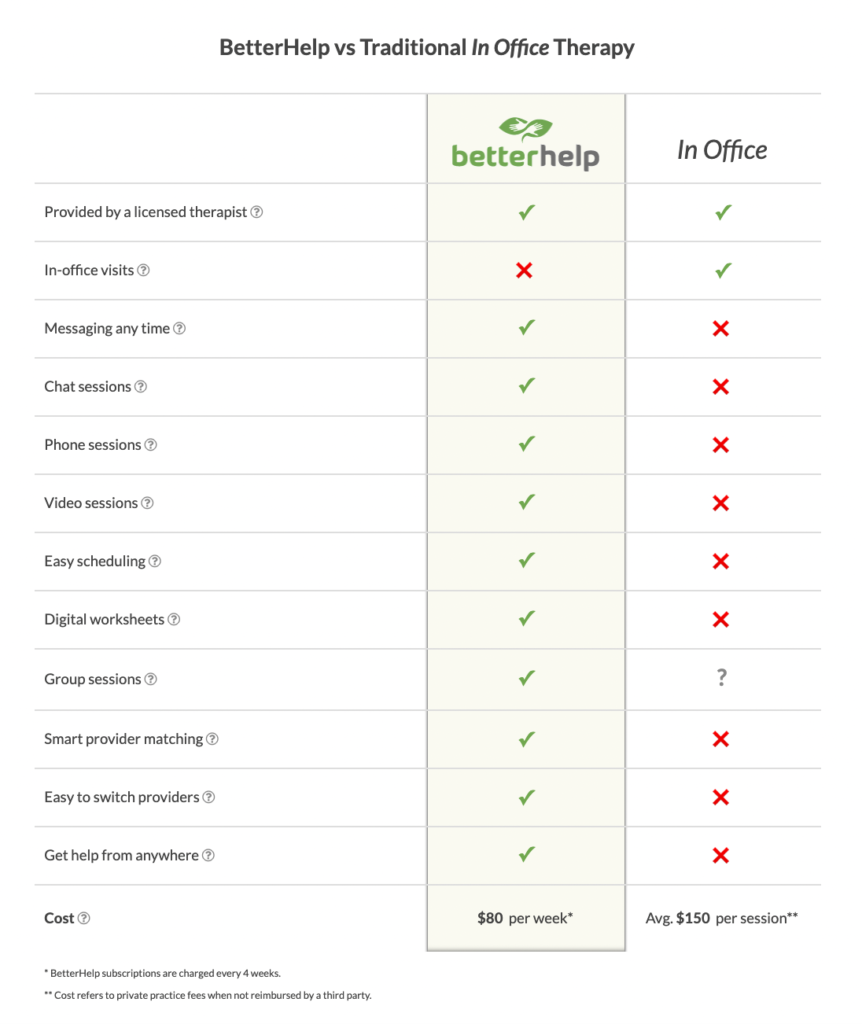

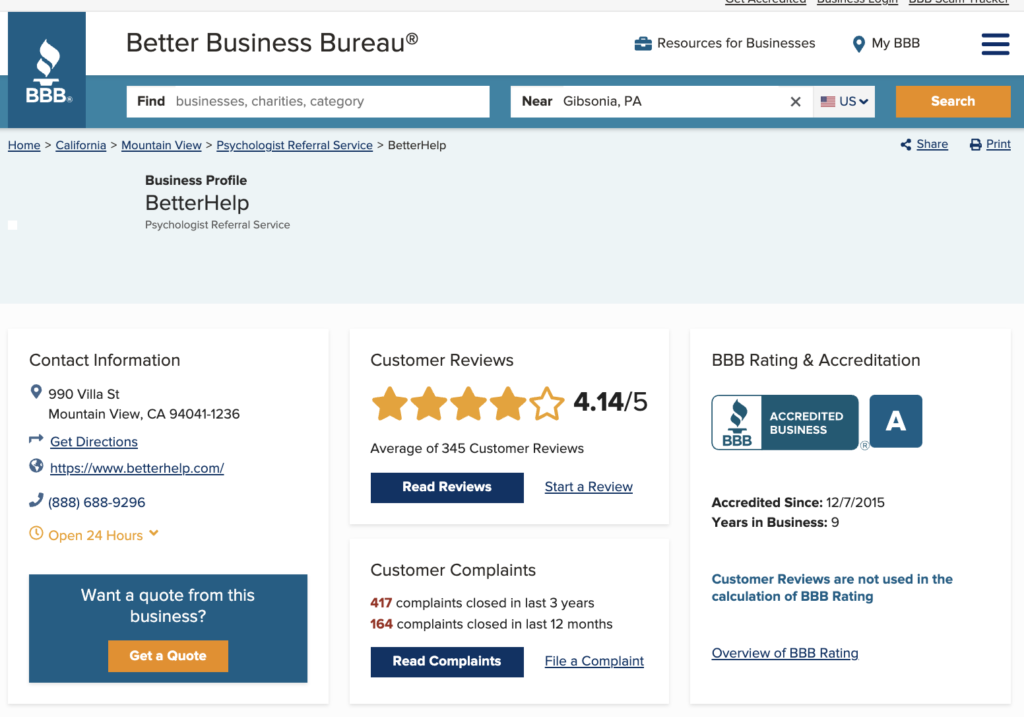

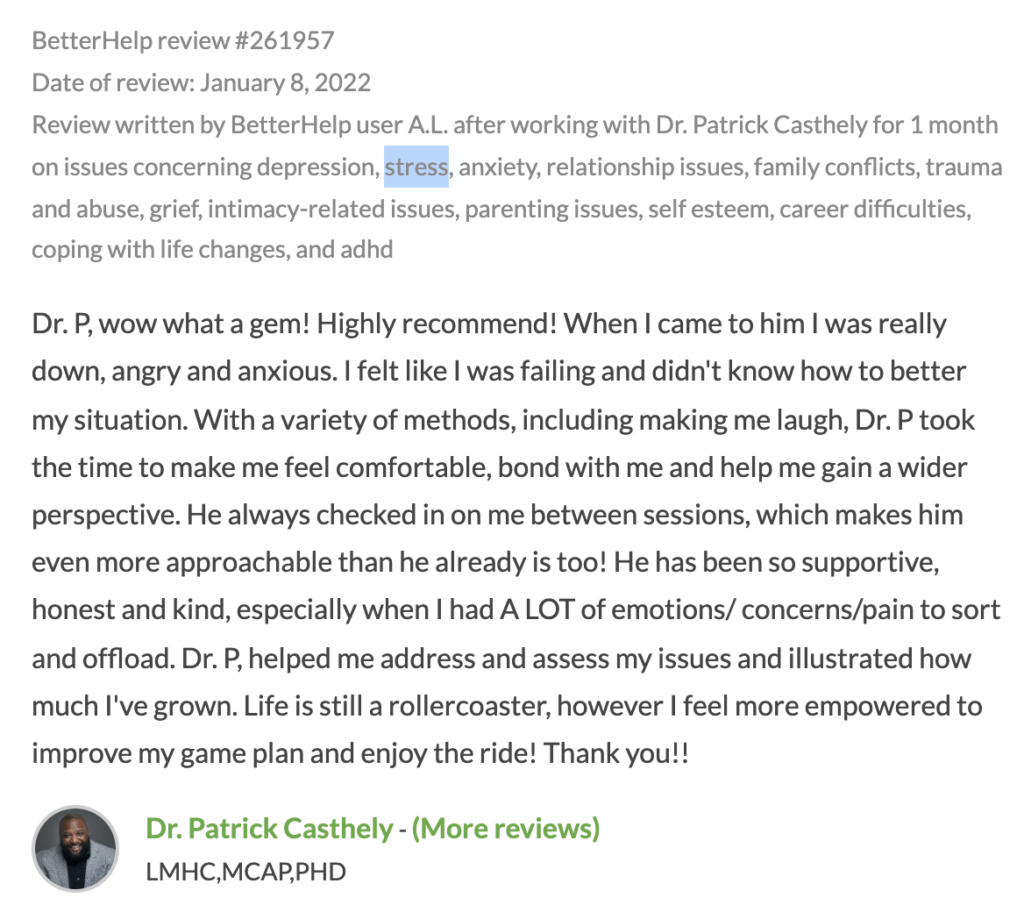

Betterhelp Review 2022 Is It Worth The Money

Shipping Costs And Return Policy Nespresso Usa

Is Selling On Etsy Worth It In 2022 Made Urban

Check Your Tax Form On Robinhood Robinhood Is Incorrectly Washing Trades R Options

Is Selling On Etsy Worth It In 2022 Made Urban

Betterhelp Review 2022 Is It Worth The Money

Information About How To Cancel Your Aarp Membership

Shipping Costs And Return Policy Nespresso Usa

Betterhelp Review 2022 Is It Worth The Money

Shipping Costs And Return Policy Nespresso Usa

Betterhelp Review 2022 Is It Worth The Money

Is Selling On Etsy Worth It In 2022 Made Urban

Shipping Costs And Return Policy Nespresso Usa